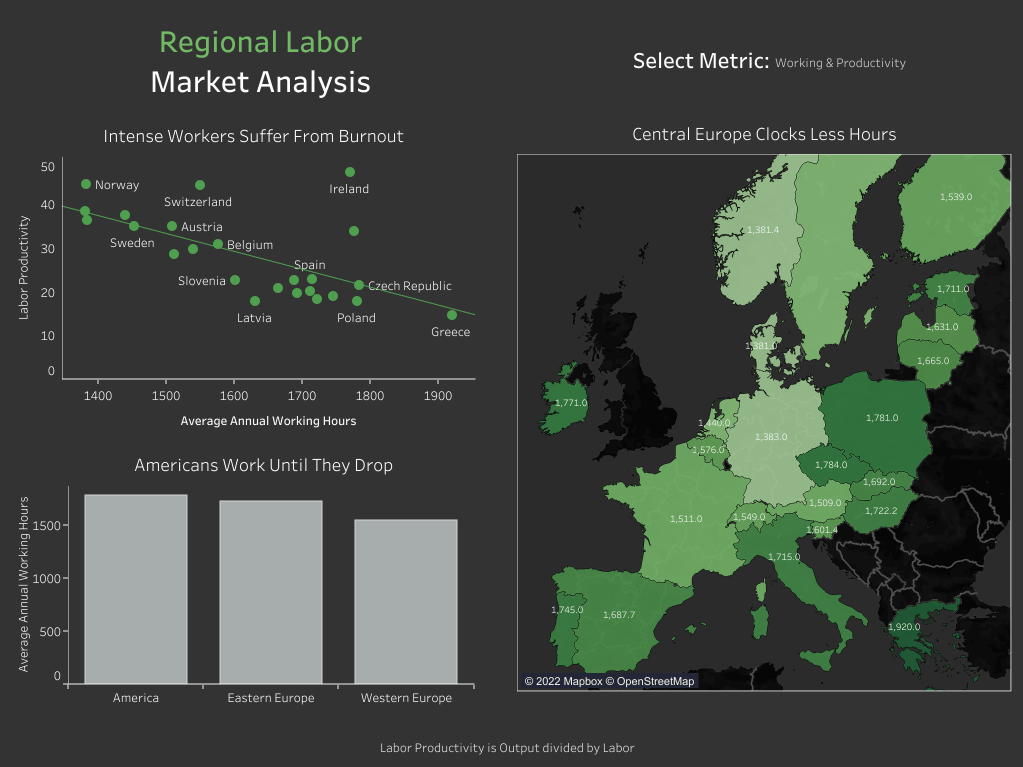

Labor Market Analysis

Summary

This project examined how payroll taxes impact willingness to work in various countries. I created a dynamic mathematical model in Excel and displayed the results in a professional, interactive dashboard using Tableau. Our team came to the conclusion that higher tax rates discourage working and account for roughly 25% of the difference between European and American working hours.

Dashboard

Data Collection

Europeans tend to work less and pay more taxes than Americans. Our team hypothesized that higher payroll taxes may discourage Europeans from working and are a contributing factor to different working patterns. In order to test our hypothesis, we collected data from the OECD for 25 different countries. Our team compared government spending to labor hours worked and observed a negative correlation using regression analysis. In other words, when the government spends more money, people tend to work less.

Mathematical Model

To model the behavior of the labor market, we examined the equilibrium between labor supply and labor demand. Labor supply was determined by the average consumer whose objective was to maximize utility subject to a budget constraint. Labor demand was determined by the average firm whose objective was to maximize profit subject to a set amount of capital.

Our team derived the objective functions subject to their constraints and used a system of equations to find a dynamic equation for equilibrium wage and working hours. We adjusted parameters in the model and observed the impact of tax rates on the working hours, government revenue, output and consumption.

As tax rates increased, government revenue and average wages increased while average working hours, output and consumption decreased. When tax rates increase, people are discouraged from working and don’t have extra income to spend on various goods. Companies also produce less with fewer workers and are incentivized to pay higher wages to attract more workers.